Frequently Asked Questions

All You Ever Wanted to Know About Insurance

Personal Insurance: Auto Insurance

Exclusions

UBER, Lyft, and Rideshare answers

How to “void” all coverage under your Personal Auto Policy (PAP)?

Just sign up with a mobile app service like UBER or Lyft and provide your vehicle as a ride service like a taxi for hire.

Before you sign up with Uber or Lyft you need to know that the auto insurance issues are complex. Special insurance is required to avoid being uninsured for both auto liability and physical damage protection for your vehicle.

Virtually every PAP excludes all coverage - liability, uninsured / underinsured motorist, medical payments and physical damage - if your vehicle is:

- Used as a public or livery conveyance. (the public pickup and delivery of: people - like a taxi cab, limo or shuttle; or goods - like a public delivery or freight company)

This exclusion is not new and in fact has been a main exclusion in Personal Auto Policies for many decades. To keep the PAP affordable for all drivers, the premiums charged do not include the risks associated with commercial business use like public taxi cabs or freight companies. That does NOT mean that vehicles used in your business or that all business use is excluded (read: Does my Personal Auto Policy exclude "business" use?) – but this specific use is directly excluded.

To strengthen this Public or Livery exclusion the Insurance Services Office (ISO) has developed a new endorsement known as the Public or Livery Conveyance Exclusion Endorsement (PP 23 40 10 15). It defines the “Transportation Network Platform” and clarifies the exclusion in the auto policy. The endorsement excludes liability, medical payments and physical damage while the auto is being used by an insured who is logged into a transportation network platform as a driver, whether the insured has a passenger in the car or not. The endorsement takes effect Oct. 1, 2015, in Iowa, Maine, Montana, New Mexico, Wisconsin and Wyoming. It is effective Nov. 1 2015, in Colorado, Indiana and Nevada, and effective Dec. 1, 2015, in Delaware and Idaho.

THEN, THERE WAS UBER

Uber Technologies Inc. is an American international transportation network company headquartered in San Francisco, California. The company develops, markets and operates the Uber mobile app, which allows consumers with smartphones to submit a trip request which is then routed to Uber drivers who use their own cars as a taxi service. By May 28, 2015, the service was available in 58 countries and 300 cities worldwide.

Since Uber's launch, several other companies have copied its business model, a trend that has come to be referred to as "Uberification". Uber was founded as "UberCab" by Travis Kalanick and Garrett Camp in 2009 and the app was released the following June. Beginning in 2012, Uber expanded internationally. In 2014, it experimented with carpooling features and made other updates. By mid-2015, Uber was estimated to be worth $50B. The legality of Uber has been challenged by governments and taxi companies, who allege that its use of drivers who are not licensed to drive taxicabs is unsafe and illegal. Source: UBER on Wikipedia.

INSURANCE PROBLEMS

Now suddenly, everyone who owns a private passenger auto and a smart phone can be in the taxi business. As Uber has been building its business model there have been clashes with existing legal and business structures – taxicab drivers, labor laws, state statutes, local regulations and insurance coverage. Each area is needing to adjust to adapt to this changing industry.

In the meantime, anyone who uses their private passenger auto for hire with Uber or similar taxi service needs to know that they will not be covered by their auto insurance policy. An uncovered claim exposes the Uber driver to financial disaster in exchange for a part-time taxi job. No auto liability coverage for bodily injury or property damage lawsuits. No legal defense. No uninsured motorist and auto medical payments. No physical damage coverage to repair your wrecked or totaled vehicle.

INSURANCE SOLUTIONS

INSURANCE SOLUTIONS

The insurance industry is slowly finding an approach to provide the needed coverage. Affordable coverage is available now under a Commercial Auto Policy but this may still be too expensive a solution for the part-time Uber driver. A few insurance companies are developing endorsements to their Personal Auto Policies to cover a driver and vehicle when under Uber type hired use.

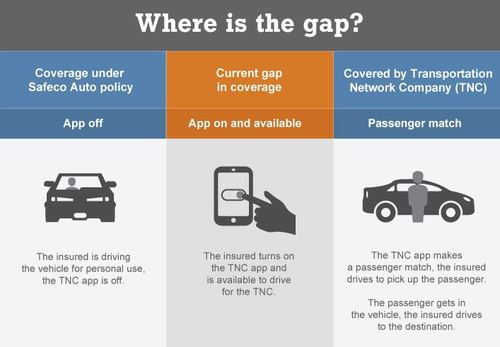

Safeco, for instance, offers a RideShare coverage endorsement option to close the "gap" that your personal auto coverage otherwise might not otherwise cover. This endorsement costs about $10/month.

For the latest insurance solutions for Uber, Lyft or or other RideShare coverage plans, please Contact Us at AMERICAN INSURANCE.