Frequently Asked Questions

All You Ever Wanted to Know About Insurance

Risk Management: Business Auto

General

Vehicle Use Policy reduces business auto claims

Business owners that have commercial autos may need to take action to curb increases in insurance premiums.

AMERICAN INSURANCE is providing free resources and risk management assistance so business owners can reduce losses and mitigate the impact of potential double-digit rate increases.

The U.S. commercial automobile insurance segment's underwriting losses deepened to $4.0 billion in 2019, the segment's worst loss in 10 years and a continuation of a decade-long trend of worsening underwriting results, according to a new AM Best report. Despite double-digit, year-over-year increases in earned premiums, the growth in incurred losses and loss adjusted expense (LAE) has outpaced earned premium growth, reflecting more frequent and costlier claim litigation, the report said.

Mobile Device Distractions Are on the Rise

Using mobile devices while driving increased from pre-pandemic levels.*

- Texting or emailing: 26%, up from 19% pre-pandemic

- Checking social media: 20%, up from 13% pre-pandemic

- Taking videos and pictures: 19%, up from 10% pre-pandemic

*Source: 2021 Travelers Risk Index on Distracted Driving for Businesses

Reducing Premium Increases

Whether you have a few vehicles or a large commercial fleet, business owners must actively manage the risks that drive claims experience – vehicle inspections and maintenance, vehicle use and controls, driver qualifications and behaviors, and a written comprehensive Vehicle Use Policy that is monitored and enforced. Larger commercial vehicle fleets may also benefit from GPS telematics software programs that can create a digital use history while monitoring the real-time location, speed and driver behaviors for each vehicle.

- Related article: GPS vehicle telematics programs for businesses

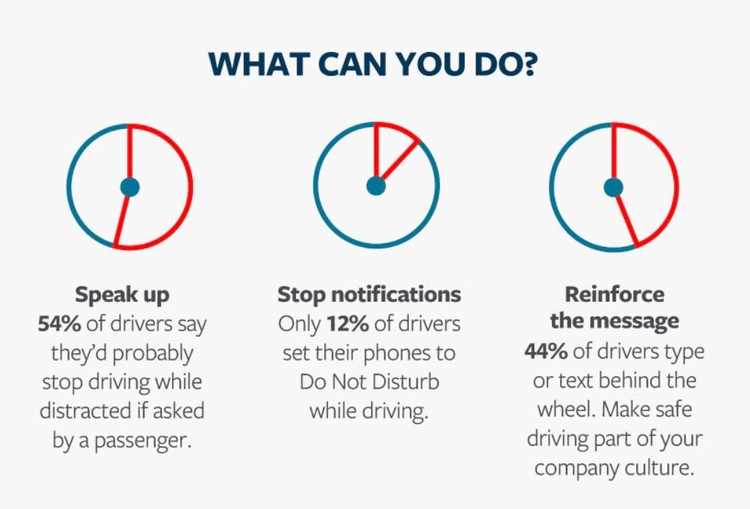

Safeguard Your Business with a Distracted Driving Policy

Employees who drive during the course of their work may also drive up their employer’s risk factors if they fall prey to distractions behind the wheel. The 2017 Travelers Risk Index indicates that 30% of all businesses worry “a great deal” or “some” about distracted driving putting their company at risk. Yet, the data provides that 27% of employees who drive in the course of their work say their boss has called and/or texted even though their boss knew they were driving.

Considering the potential dangers and costs associated with vehicle accidents, distraction caused by mobile device use is a key problem for employers to address. However, according to the Travelers Risk Index, only 27% of employers reported having a formal policy on distracted driving that was strictly enforced.

A clear distracted driving policy can help to improve driver safety and the safety of anyone that may be involved in a distracted driving accident.

Here are four steps to help make your distracted driving policy more effective:

- Create – Create a formal, written policy stating your organization's position on mobile device use while driving. Consider other distractions as well. A formal policy is the foundation of your distracted driving prevention program. It should apply to everyone in your organization who drives a vehicle on company business, whether they drive a delivery truck, a sales vehicle, or use a personal vehicle to run office errands.

- Communicate – To be most effective, safety policies should be communicated on a regular basis. Have every employee who drives on company business acknowledge in writing that he or she has read, understands and will follow the policy. But don’t stop there. Use emails, newsletters, bulletin board postings, driver training and signage in vehicles to communicate your policy in various ways throughout the year.

- Follow – Managers and office staff should lead by example. Let employees know that while they are on the road, no phone call or email is more important than their safety. To further prove that point, managers and other staff need to refrain from calling or texting employees until they are safely parked.

- Promote – Managers are in the best position to promote safe driving practices and the expected behaviors of those that drive for any business purpose. They can take steps to understand who is following these policies, and actively reinforce the desired behavior.

Free Customizable "Vehicle Use Policy"

Take the first step and Contact Us by sending a message to AMERICAN INSURANCE for a free comprehensive and customizable “Vehicle Use Policy” document. And, if you are faced with a large premium increase or just want to check the insurance Marketplace for lower rates, we invite you to contact our agents at AMERICAN INSURANCE. We quote many top insurance companies with your one request to find you the best price and coverage available in the Marketplace today.

Source: Travelers Business Distracted Driving information page

Related articles

Read more articles about: