Frequently Asked Questions

All You Ever Wanted to Know About Insurance

Business Insurance: Liability

Other Coverage

Employment Practices Liability (EPLI) – why every business needs coverage

What if you opened your mail today and found a discrimination complaint had been filed against you with the State Human Rights Commission or US Equal Employment Opportunity Commission (EEOC)? Or worse yet, a civil lawsuit for discrimination had been filed. Your worst day ever would likely stretch to your worst year ever!

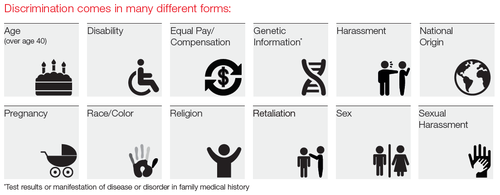

Discrimination complaints flow out of State and Federal laws against employment discrimination. They apply to all types of work situations, including hiring, firing, promotions, training, wages, and benefits. Most federal employee discrimination laws apply to companies with 15 or more employees. States may require compliance from even smaller companies and have laws in place that exceed US Federal recommendations. These laws are complicated and complaints are on the rise.

THE PROBLEM:

Employers large and small are increasingly targets of lawsuits alleging a “wrongful employment act” that violates employment rights protected by law – wrongful termination, discrimination, sexual harassment, hostile workplace, retaliation, invasion of privacy, and numerous variations of these topics.

THE SOLUTION:

Is special insurance needed? YES! Employment discrimination claims are specifically excluded on Commercial General Liability policies, that primarily cover accidental bodily injury or property damage liability claims on your premises or because of your business operations or products. A specialized form of insurance called “Employment Practices Liability” (EPLI) has developed to help employers insure the litigation costs and judgments resulting from employment discrimination claims.

Employment Practices Liability Insurance (EPLI)

Now EPLI coverage is readily available for nearly every business – large and small – at very affordable premium rates.

- EPLI for public companies and non-profit organizations is offered as an endorsement to Directors & Officers Liability policies or on a stand-alone basis.

- EPLI for private for-profit companies is available on a stand-alone policy basis.

- EPLI for small business is offered as an endorsement under most Business Owners Policy (BOP) forms at very low rates with policy limits up to $100,000.

AMERICAN INSURANCE specializes in EPLI, Directors and Officers Liability and other Professional liability coverage with direct access to America’s top insurance companies for large and small employers of every kind. Contact us for more information.